Not Every Decision Is a Financial Decision, Financial Advisors Need To Focus on Client's Happiness, LFG Daily - November 12, 2025

- Luke Lloyd

- Nov 12, 2025

- 5 min read

Dream Bigger, Sleep Better

At Lloyd Financial Group, we’re constantly striving to give you more insight, more clarity, and more confidence when it comes to your money. Our Chief Investment Officer, Colin Symons, now delivers his own daily newsletter, offering deep analysis and a detailed outlook on the ever-changing investment world called Symons Says. Check it out and subscribe if you want a very detailed, daily analysis of the investment world. Colin has amazing content.

Meanwhile, the LFG Daily will continue to bring you quick, actionable summaries — blending market updates with financial planning and tax strategies to help you make smarter decisions every day. Together, they’re the perfect one-two punch: Colin brings the deep dive into Investments, we bring the daily edge.

Luke Lloyd, CEO Lloyd Financial Group

Not Every Decision Has to Be the Perfect Financial One

Many financial advisors are chest-out, and stuck in thinking the most important thing is money. Financial Advising isn’t about money, it’s about life.

In the world of financial planning, it’s easy to get caught up in optimization. We talk about tax efficiency, investment returns, retirement savings, and maximizing every dollar — and all of that matters. But here’s the truth: not every decision you make has to be the perfect financial one.

Because at the end of the day, your life isn’t meant to be a spreadsheet — it’s meant to be lived.

We all want to build wealth and financial freedom, but money is just a tool. The real goal is happiness, purpose, and meaning. And for many people — especially younger generations today — that’s what’s missing.

The Purpose Deficit

You can feel it in conversations with young professionals. So many don’t view their jobs as careers — they view them as paychecks. They’re showing up, getting through the week, and counting the hours until the weekend. There’s no passion, no pride, no sense of building something bigger than themselves.

And it’s not just about work. Young people are delaying or avoiding marriage, opting out of having kids, and struggling to find purpose beyond the next trip, next purchase, or next promotion.

Let me be clear — I’m not saying you have to get married, or have kids, or climb the corporate ladder. Those choices are deeply personal. But what I am saying is that those kinds of commitments — building a family, pursuing a calling, investing in relationships — often create a sense of meaning that no amount of money or short-term pleasure can replicate.

Because purpose comes from responsibility. It comes from connection. It comes from doing something that matters to you and to others.

The Financial Illusion

In personal finance, we can trick ourselves into thinking that if we just make all the “right” decisions — save more, spend less, invest early, stay disciplined — happiness will naturally follow. But it doesn’t always work that way.

Sometimes, the best financial move on paper isn’t the right move for your life.

Maybe it’s taking a lower-paying job that excites you. Maybe it’s moving closer to family, even if it costs more. Maybe it’s splurging on experiences that create lifelong memories.

If those things bring you joy and purpose, they’re not bad decisions — they’re human decisions.

Balance Over Perfection

Good financial planning isn’t about chasing perfection. It’s about balance — finding the sweet spot between fiscal responsibility and personal fulfillment. Money should serve your life, not run it.

So, build the plan. Save wisely. Invest with intention. But don’t lose sight of why you’re doing it in the first place. Because the richest life isn’t the one with the biggest account balance — it’s the one filled with purpose, relationships, and meaning.

Final Thought

At the end of the day, wealth without purpose is just numbers on a screen. Purpose gives those numbers meaning.

So go live a life that’s more than financially perfect — live one that’s personally fulfilling.

Don’t leave your financial future up to chance. Let’s build a plan that gives you confidence today and peace of mind for tomorrow. Click here to schedule a meeting — I’m here to help you take the next step toward financial freedom.

Colin Symons, CIO Lloyd Financial Group

NFIB Small Business Optimism was 98.2 vs. exp. 98.3. Earnings are a significant negative, though.

ADP Private Employment was -11K vs. prev. 14K.

China is struggling with a shortage of advanced domestic semiconductor chips.

Japanese Finance Minister Katayama said a weak yen is causing negative effects in the economy.

Japanese Machine Tool Orders were 16.8% Y/Y vs. prev. 11%, while the Tankan Manufacturing index was 17 vs. prev. 8. Doing well, over there.

JPM is rolling out a coin to institutional clients as banks broaden their digital footprint.

AMD is up 5% as investors cheered growth prospects from their investor day.

Plenty of Fed speeches, today. We should also see the House vote on the spending bill this afternoon, which is the highlight of the day.

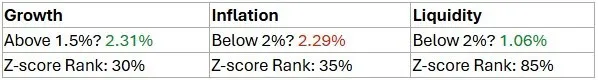

What does it all mean? The big activity today is the expected passage of the spending bill in the House, this afternoon. That should get us closer to getting liquidity back.

Don’t leave your financial future up to chance. Let’s build a plan that gives you confidence today and peace of mind for tomorrow. Click here to schedule a meeting — I’m here to help you take the next step toward financial freedom.

Disclosures/Regulation:

This content is intended to provide general information about Lloyd Financial. It is not intended to offer or deliver investment advice in any way. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Past performance is no guarantee of future returns.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Comments